Offer OPEN to wholesale and other qualifying investors directly via Black Robin and to retail and wholesale investors via Catalist

McKenzies Shute Limited

Class A Shares

Investors receive up to 9.95% p.a. (less DWT) paid as quarterly dividends in arrears, plus a share of potential development profits once the project is complete.

Minimum Investment – Catalist Offer

$5,000

Minimum Investment – Wholesale Offer

$50,000

Equity raised so far

$2,430,234

The Offer

OFFER OPEN

Black Robin proudly presents an offer of Class A shares in McKenzies Shute Limited.

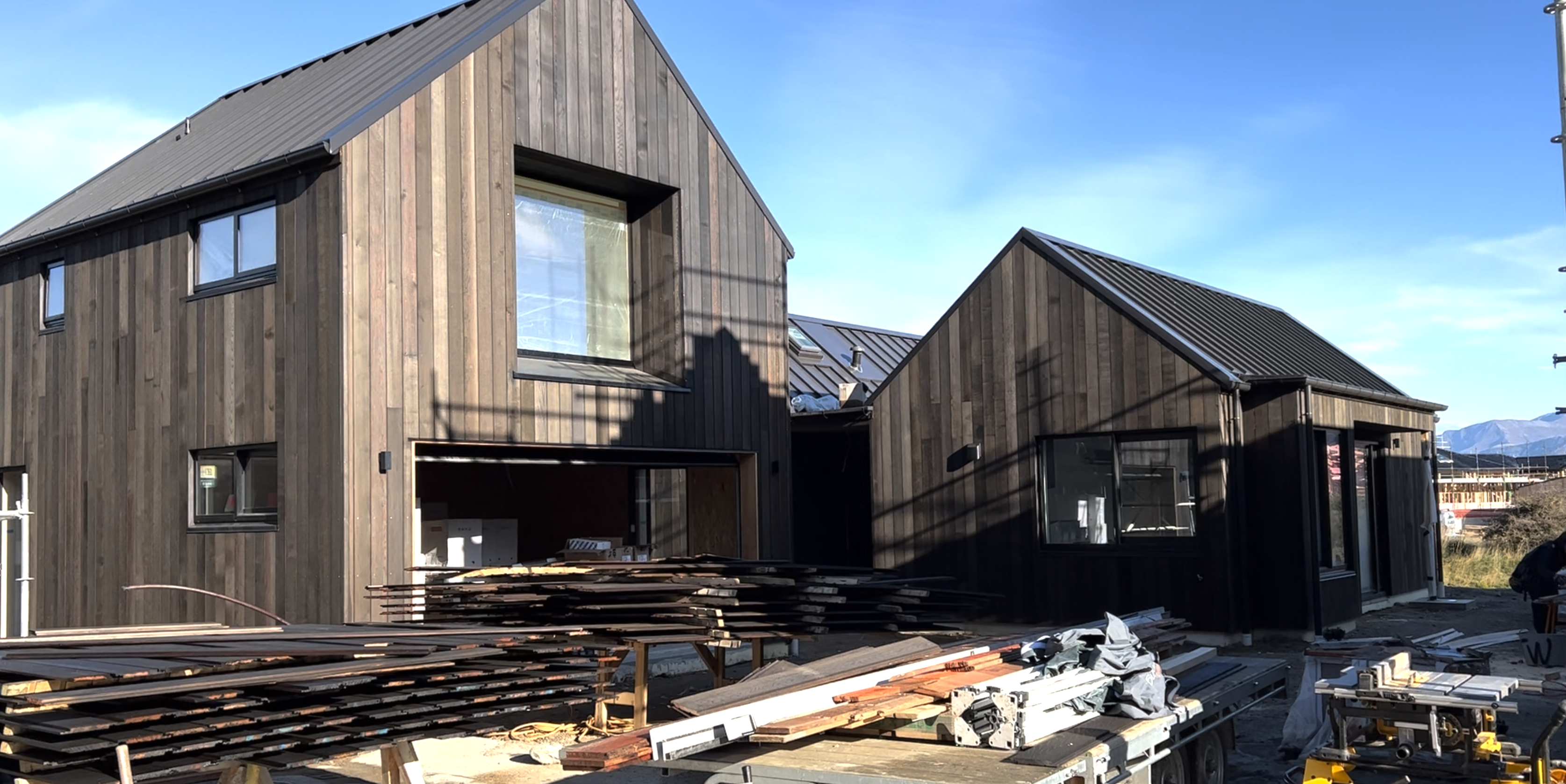

This development of three alpine villas is nestled in the majestic landscape of Queenstown, in the suburb of Jack’s Point.

As at 14 June 2023, there are only 850,000 Class A Shares available. Practical Completion of the Villas is scheduled for June 2023.

At completion, the directors intend to return your initial investment along with a share of the potential profits from the development, or alternatively you may elect to convert your shares and remain in the company as it expands and grows its operations.

Property development carries inherent risks (as do all financial products) which may affect performance of this investment. For more information about the risks, please refer to section 7 of the Information Memorandum.

Estimated Investment Term

12 months

Dividend Yield

Plus

Profit share

Investment Type

Equity investment

Want to invest?

Interested investors may request our full Information Memorandum and accompanying documents by using the link below to register your interest directly with Black Robin, or by registering via Catalist

A Black Robin investment is different

We’re on your side

We pay dividends

We understand how important it is for an investor to have cashflow. We intend to pay quarterly dividends on the Class A shares at 9.95% p.a. (less DWT), subject to compliance with the Companies Act 1993.

We have the know-how

Our capability spans all property asset classes and we have completed hundreds of millions of dollars worth of property transactions.

We share our profits

We share the potential development profits with Class A shareholders at the completion of the development.

We offer reinvestment

Investors have the ability to reinvest their quarterly dividends during the term of the investment to enhance their returns.

We

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Egestas sit tortor nunc euismod porttitor. Pretium, cursus amet sit nisl nec, aliquet tincidunt volutpat. Quam a scelerisque aliquet lectus et, sed quisque tellus.

Current projects and share offers

FAQ's

Most frequent questions and answers

McKenzies Shute Ltd is a subsidiary of Black Robin Equity Limited, and is the company making the offer of Class A shares and the developer of three luxury alpine villas. McKenzies Shute is also the name of the street where the development is located, which is within Jack’s Point. McKenzies Shute street is approximately 10 kms by road south of Queenstown Airport.

Jack’s Point is a luxury estate located 16 km south of Queenstown, at the foot of The Remarkables mountain range and close to the edge of Lake Wakatipu. It is internationally renowned for its golf course and is rated among the top 10 lifestyle estates in the world. The estate is a new development, planned to eventually consist of some 1,300 houses and looking to serve a population of 7,000. It takes its name from “Māori Jack” Tewa, a local 19th century personality.

The development has all the required resource consents and building consents from Queenstown Lakes District Council.

The development is for three luxury alpine villas, as well as a nature reserve to be vested with the Jack’s Point Residents and Owners Association.

McKenzies Shute Ltd (as the Developer) is raising money from the public as part of the Black Robin mission to bring property development investment opportunities to the wider investing public. To date there have been limited property development investment opportunities and those that have been available have been restricted to wholesale and eligible investors, often with a minimum investment amount of $50,000 or more.

The information memorandum (IM) sets out three pre-conditions that must be satisfied before McKenzies Shute Ltd can access and use investors funds. These are:

- Reaching the minimum subscription level of $2 million from investors under this offer;

- The conditions precedent of any construction loan offer are capable of being met; and

- Titles being issued by LINZ for each of the three villas to be built*.

*(Note that titles have already issued, thus this condition has been satisfied.)

Only when all three conditions are satisfied will the directors of McKenzies Shute pass a resolution to allot the shares. Only then will it be able to use investors’ funds.

The head contractor is Hector Egger Construction Services Ltd.

Hector Egger Construction Services Ltd is a Cromwell-based joint venture business between Swiss company Hector Egger Holzbau AG and two Queenstown-based partners. It specialises in manufacturing high-tech timber structures and prefabricated timber panels for residential and commercial building construction. It uses well established offsite manufacturing solutions pioneered by Hector Egger Holzbau AG, which has 20 years’ experience in offsite manufacturing of timber buildings and structures, with three ISO 9001 certified factories operating in Switzerland.

Hector Egger has a factory in Cromwell utilising technologies sourced from its Swiss based 50% shareholder. Hector Egger Construction Services is also a registered Master Builder.

McKenzies Shute Ltd is developing three, four-bedroom luxury alpine villas.

In addition to the funds raised from this Class A offer of shares, funds are also being sourced via a first mortgage construction loan plus funds provided by McKenzies Shute’s parent company, Black Robin Equity Ltd.

Black Robin Equity Limited is a New Zealand owned and operated company focused on property developments in New Zealand’s major urban centres.

Black Robin’s mission is to provide quality homes for New Zealanders and provide the opportunity for investors to share in the profits and returns from its property development activities.

Black Robin brings together a team of people with a wide range of skills and experience in the development of residential property, including investors, professional consultants and advisors, as well as those with direct experience of financing and managing residential property developments.

For more information, head to About Us

Black Robin is based in Auckland, New Zealand.

Class A shares are shares issued to both wholesale and retail investors in McKenzies Shute Ltd. There is one other class of shares on issue, being Class B shares, exclusively held by Black Robin Equity Ltd.

Class A shares have rights to dividends and redemption ahead of Class B shares as set out in the constitution of McKenzies Shute Ltd as well as full voting rights. Class A shares are entitled to a dividend of up to 9.95% per annum, paid quarterly as well as a pro-rata share of the development profits, if any.

Class A shares, held by investors, rank ahead in all respects of Class B shares, held by Black Robin Equity Ltd. This is set out in the constitution of the McKenzies Shute Ltd.

This means that all dividends due and payable to Class A shares, along with redemption of the Class A shares at the completion of the development (including the sale of the three alpine villas) must occur before any funds can be paid to the Class B shares.

Funds raised from investors, along with funds borrowed via the construction loan and funds from Black Robin Equity Ltd, will be used to settle the land and fund the construction of the three alpine villas as well as fund other operational costs of McKenzies Shute Ltd,.

There is no fixed term of investment. McKenzies Shute Ltd expects, based on information currently available, that the development will be completed in March 2023 with the sale and settlement of all the villas by the end of June 2023. This would mean an investment term of approximately 12 months from June 2022.

In order to invest in the Class A shares offered by McKenzies Shute Ltd you must first create an account with Catalist. Once the account is active you will be able to make an application for Class A shares. Please note that the minimum subscription is $5,000.

Sign Up / Login to Catalist here

Wholesale investors may also invest via Catalist, or by contacting Black Robin directly and providing the appropriate investor certificate.

Once you have paid your investment to Catalist’s Trust Account, your money is held in the trust account and developer cannot use it, until Catalist is satisfied that the shares have been allotted meaning you have legal title to your shares in McKenzies Shute Ltd. Allotment occurs once the conditions have been met (see “When will the developer use my money”).

After the payment of all costs, repayment of all borrowings and payment of all dividends and share capital due to the Class A shareholders, the developer retains any and all profits remaining.

The profit share is based on the total profit earned by the Company (if any), after the deduction/payment of all costs, divided by the total number of Class A and B shares on issue.

For example, if the Class A shareholders hold 20% of the all shares on issue, then the Class A shareholders will receive 20% of the profit. If the Class A shareholders hold, for example, 15% of all shares on issue, then the Class A shareholders will receive 15% of the profit.

McKenzies Shute Ltd intends to hold periodic auctions via the Catalist public market to enable the trading of shares. The first is expected to occur in Spring 2022. The auctions provide a facility for Class A shareholders to buy and sell shares, or for other Catalist investors to buy shares. Class B shares can not be traded.

The ability to buy or sell shares during an auction depends on the number of buyers and sellers that may willing to trade at a price you may be willing to trade. McKenzies Shute Ltd cannot provide any guarantee as to the number of buyers or sellers who may participate in the auctions nor the prices that shares may trade at.

As the offer is for Class A shares there is no right of redemption by any shareholder.

At the completion of the development and the sale/settlement of the three alpine villas it is the intention of McKenzies Shute Ltd to repurchase, by way of redemption, and cancel the Class A shares. This will occur once the construction finance has been fully repaid and all other costs accounted for. As the shares are being issued for $1.00 per share the amount paid to repurchase your shares is also expected to be $1.00 per share.

As McKenzies Shute Ltd is listing on the Catalist Public Market there may be an opportunity to sell your sales via the periodic auctions that are planned to take place, although there is no guarantee that there may be sufficient buyers at a price you may be prepared to sell.

Dividends are intended to be paid once the pre-conditions (see “When will the developer use my money?”) are satisfied, and the shares have been allotted.

Dividends will then be declared at the end of each calendar quarter, being the end of March, June, September, and December, with the payment to Class A shareholders made on the 15th of the following month.

Dividends are only payable if the Company has sufficient cash flow and the directors are satisfied that the solvency requirements of the Companies Act are satisfied.

Please note that Class B shares have no rights to dividends until all Class A shares have been redeemed.

Dividends on shares are taxed at the rate of 33% under current law. This means that McKenzies Shute Ltd will deduct 33% of your dividend and pay it to the IRD on your behalf.

McKenzies Shute intends to pay income tax at the company tax rate of 28% at the same time a dividend is paid, with the resulting imputation credits allocated to you, thus the effective tax paid by you will be 5%, being the difference between 33% and 28%.

If you have further questions about dividends and tax please consult your accountant or taxation adviser.

A wholesale or eligible investor is a person that meets certain criteria as set out in Schedule 1 of the Financial Markets Conduct Act 2013 that enable a lower level of disclosure to be made to that person, as compared to a regulated offer as defined by that Act.

Wholesale investors (including eligible investors) have to provide certifications as to their status as one of these types of investors and may require independent confirmation from their accountant, lawyer or financial adviser of their status.

A retail investor is any person that is not a wholesale investor in relation to the offer.

Almost everyone is a retail investor. Wholesale and eligible investors are a special class of investor that has to provide confirmation of their status as part of application process.

Traditionally, property investment offers are often only available to wholesale investors, because offers to wholesale investors can have more limited disclosure than would normally be the case under the Financial Markets Conduct Act 2013, which is cheaper for the business making the offer.

Businesses offering investments listed on the Catalist Public Market have been granted an exemption by the Financial Markets Authority (FMA) from some of the requirements under the Financial Markets Conduct Act 2013, which lowers the cost of making an offer to retail investors, whilst still ensuring retail investors are in a position to make confident and informed investment decisions. The market rules approved by the FMA include a requirement to disclose all material information to investors.

This means that businesses like Black Robin are able to make their offers available to retail investors (as well as wholesale investors) on the Catalist Public Market so long as we comply with the FMA-approved market rules.

If you are a New Zealand tax resident, evidenced by having an IRD number, and have an account with Catalist you can invest in this offer. Please note that the minimum subscription is $5,000 through Catalist.

If you qualify as a wholesale investor, you may invest either through Catalist or directly through Black Robin.

AML stands for Anti-Money Laundering and is a process required by law to ensure the bona-fides of every investor. The process is generally quite quick and need only be done once.

No money can be invested unless the investor has passed the AML requirements of Catalist.

Investment in McKenzies Shute Ltd is an investment in ordinary shares in a company, and no person offers any guarantee of any type.

McKenzies Shute Ltd is a property developer, and therefore has a higher level of investment risk compared to other forms of property investment such as listed property companies, property syndicates and directly owned rental properties.

Property development carries inherent risks, as do investments in all financial products. These risks may affect the performance of your investment and your ability to achieve returns or get your money back. For more information about the risks, please refer to section 7 of the Information Memorandum available once you sign up on Catalist. Black Robin recommends that investors ask questions and seek independent advice.

Catalist is New Zealand’s only licensed and regulated stock exchange, designed for investing in small and medium-sized businesses. Catalist is licenced by the Financial Markets Authority.

https://www.catalist.co.nz/info/faq